Sounds a bit crazy, that anyone could think up that many tradable ideas, develop, test and then put them into action. But it’s not so crazy if you have a process, and you’re motivated.

So, what’s the motivation? The motivation is to build an automated trading system that has some very desirable characteristics, like very small draw downs, a smooth equity curve, and distributed risk. But to achieve this, you need a process and a framework.

Most retail algorithmic traders are on a perpetual hunt for the killer strategy. They believe there is a holy grail, and if they push hard enough, if they optimize enough, they’ll eventually stumble upon it through the brute force of determination, endless research and long hours of testing.

The Holy Grail Strategy

Does the holy grail strategy exist? Maybe, but if it does, someone has already discovered it, and they’re either keeping it close to their chest or it no longer works. Rock star strategies will emerge from time to time, depends on market conditions. But these strategies are not available to you, unless you stumble upon one, or through endless testing you find the right combination of parameters…highly unlikely.

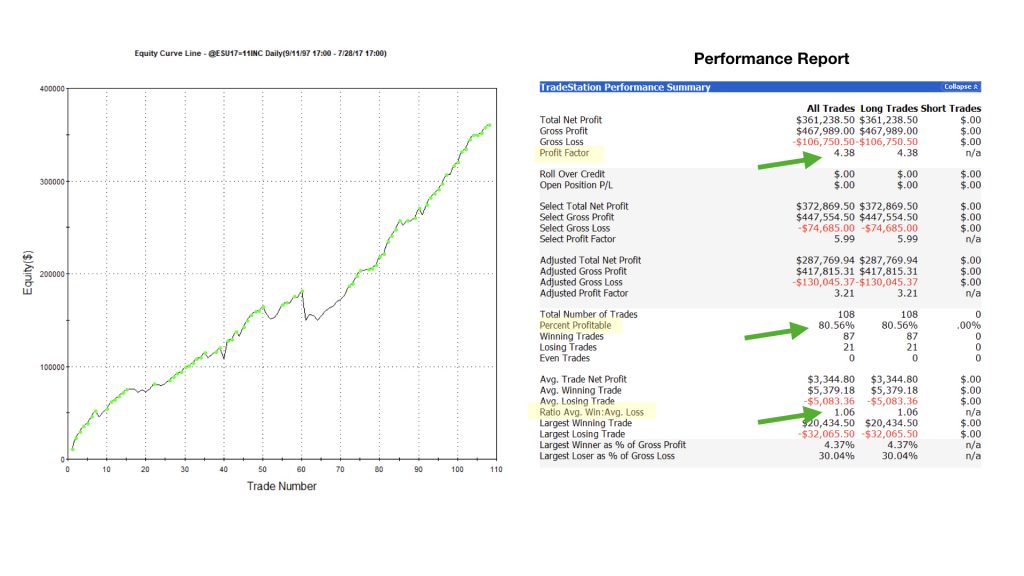

Below is a strategy that has made money for 20 years, maybe longer, I don’t know, because that’s as far back as I tested it. There are very few parameters to optimize. It’s super simple, based on a 2-period RSI using daily bars, it works across a number of markets and asset types. I found it in a book by Larry Connors and Cesar Alvarez called, Short Term Strategies That Work. Here are the rules…

- The asset being traded is above its 200-day moving average (I used the e-mini S&P 500 futures).

- Buy if the 2-period RSI drops below a level of 5.

- Exit if the asset crosses above its 5-period moving average.

I coded it up in TradeStation EasyLanguage and I’m testing it to see if it really works. It appears to be super robust. Stays in trades on average for a little over 10 days, has a very high profit factor well over 4.0, and a percent profitable that’s greater than 80%. Is this the holy grail?

The strategy isn’t perfect, in that the average winning trade versus the average losing trade is good, a such and with a really high winning percentage, but it’s a Long-Only Trade and doesn’t trade if the asset is under its 200-day moving average, so there are times I’d be sitting on my hands waiting for something to happen…extended times.

So, is this strategy the holy grail? Hardly. But that’s where other strategies might fill the holes. If I wanted to add another strategy, what should it do, how should it take trades. Is it sensible to add another long-only trader that works on daily bars? Probably not, because the returns are likely to be similar, meaning that when it does good, they both do well, and conversely when one is losing, the other is likely to be losing.

Multiple Non-Correlated Strategies

What I need to do is find another strategy to run along side this one, that has a low degree of correlation of its returns to my 2-period RSI strategy. But here’s the big questions. Do I need to find another super duper strategy? It turns out that you don’t. In fact, you are much better off adding an okay strategy, a strategy that is profitable but simple. But not just one, it’s better to add several, the more the merrier. Each one with a low degree of correlation to the others.

Low Correlation means that the strategies don’t come up with trade signals in the same way. So that when one strategy might be down, the others might be profitable. This has the effect of minimizing the overall drawdown of your portfolio of strategies, and making the profits additive.

Okay, so what does that mean? It means you need to become an idea factory. You need to come up with multiple, okay strategies and run them simultaneously. But why?

Agile Methodology

The answer has a parallel to Agile software development. And while you may not have any experience with agile development, let me describe it a bit for you, and why it works.

Agile development is about breaking up big problems into small ones, then putting together a team of generalists that can do a lot of different things, and then time boxing the project into short iterations, purposed with getting a small piece of functionality completely done with high quality results.

The key here is the iterative process, and okay experienced developers working as a team. They spread the risk, and actually do better work than a few super star developers. They are a lot cheaper too than the super stars.

Become a Strategy Making Machine

So, it turns out that if you add several non-correlated simple strategies to your portfolio, they do a much better job than one or two Rock Star strategies, for essentially the same reason that agile development teams do better. And this is where the motivation comes into play for creating lots of strategies.

Imagine if you could trade like a super star, and all you had to do was assemble several easy to code, simple, not particularly great performing strategies. Of course the strategies would have to be profitable, but there’s a lot of leeway here, the key is the low level of correlated returns, this is much more important than a killer strategy. And the more strategies you can add the better.

The thing is, strategies come and go, For periods of time they work great, then other periods they don’t. Sometimes they come to their end of life and need to be replaced. This is why you want to create as many as you can in a steady stream, and keep a number of them on the bench to test and curate, let the good ones rise to the top, and take the place of old and tired ones.

It’s not so hard to come up with new and interesting strategies, especially after you get into the swing of things. There are trading ideas everywhere, and can usually be modeled with a few simple lines of codes. Granted some may take a bit more coding expertise than you have, but those strategies are probably not critical to your success as an algorithmic trader.

Types of Strategies

There are many types or category of strategies possible. In the world of trading most people focus on price action, but the real interesting strategies are those that have some story behind them, with a solid premiss and hypothesis.

Like the effect of bonds after an anticipated Fed rate hike. The rate hike might happen, it might not, one thing is for sure, there’s a high likelihood that bonds are going to move. If you know the day and time of the rate hike announcement, or when a Fed governor might be speaking, you could create a strategy that waits for that event, then goes long or short once the market starts to move. These types of events generally have an effect on bonds for a few days. And detecting a discernible move a short period after the announcement is relatively easy to do in code.

Most strategies fall under one of the following effects on the market, they start a trend or continuation of a trend, or are counter trend makers. Some are mean reverting, or seasonally effected, others are technical, or relationships.

All you have to do is identify some thing that happens, something that interests you, or not, then apply one of these strategy types to try and capture the anticipated moves. Generally the coding is super simple. What you need to learn is how to back test your hypothesis and past events to see how your creation would have handled them. This is where process and testing skills come into play.

Conclusion

So is it possible to come up with 200 profitable strategies? Absolutely. But it takes a process, and an active imagination, and the motivation knowing the good things that will come from it. I’ve created or stole (borrowed) at least three strategies this past week. I’m on pace for generating almost 200 in a single year. They aren’t all winners, in fact a large number of them are complete flops, but that doesn’t stop the factory, rejects are part of the process.

The reality is that you’ll come up with a fairly good strategy that is ready to join your other live portfolio strategies at a rate of one in 20. The rest might have future potential, but after a while they simply need to be scrapped if they don’t meet some minimal criteria. It could be that their time isn’t right, as I’ve opened loser strategies I worked on a couple years ago, and now they perform brilliantly.

So, if your creating 200 strategies a year and 5 percent of them are winners, that means your potentially adding 10 winning, non-correlated strategies a year to your portfolio. Keep in mind, they all won’t stay winners forever, that’s why you need to keep the process going.

John Smith

February 10, 2018 at 4:19 pmvery useful – http://professionaltradingsystems.com . Try this mechanical strategy