Creating automated trading strategies is being presented as super hard work, that takes incredible discipline, lots of brain power and testing, testing and more testing. And only if you follow the prescribe thousands of steps will you achieve success.

Well I say that’s a bunch of bunk!

Now let’s be clear, I’m not saying it’s easy as pie, what I am saying is that the emphasis and effort is all in the wrong place to make a trading system a profitable system. The emphasis should not be on creating the perfect rock star strategy, this is HUGELY wasted effort.

The emphasis should be on how well one strategy plays with the other strategies. Because a successful trading system isn’t about one strategy, it’s about a community of strategies that work well together. And the mind blowing thing here is that a bunch of average strategies working together the right way, that don’t take gargantuan amounts of effort to develop, will perform way better than one or two rock star strategies.

And the total effort to build these average strategies is orders of magnitude less to create than the rock star strategy or strategies. The rock stars can consume years or even a life time of effort. Simpler strategies can be churned out weekly. The difference is the playground in which you place them and how well they play together.

The key phrase here is, you should be running multiple non-correlated strategies.

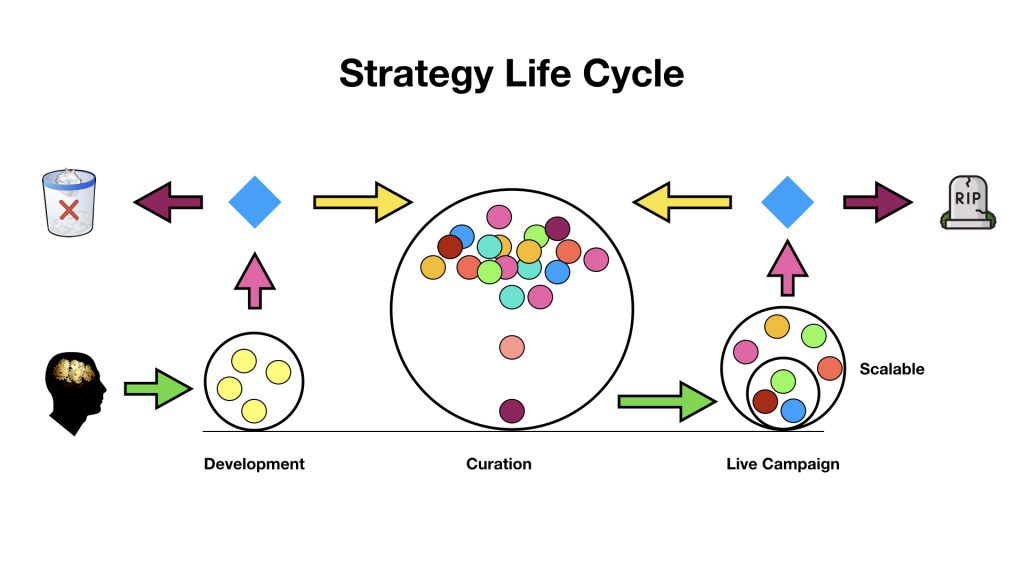

So here’s the end-to-end process, the cradle-to-grave life cycle of a strategy. Don’t be intimidated, it’s not that complex. It’s all a matter of moving the strategies from left to right as they grow up and become better citizens.

Strategy Life Cycle

The concept is pretty simple. We want to produce a bunch of average strategies that have a low degree of correlation with each other. That simply means that they generate trading signals in ways that are not related. For example, one strategy might take signals based on seasonality events, another might wait for breakouts after an economic report, another might work on lunar cycles (not kidding), while another takes signals on significant pullbacks. And we can measure the degree of non-correlation with a simple Excel function called CORREL.

There are also fantastic tools that let you organize your portfolio of strategies into one consolidated performance report, that will show the correlation as well as the combined statistical measures. TradeStation has such a tool called Portfolio Maestro, and there are third party tools like PortfolioMerge.

Ok, so let’s look at the picture above. Our goal is to move strategies from the idea phase on the left, to the live campaign on the right. About one in twenty strategies will make it to the campaign. Not a big deal when you get my course as I provide you with a bunch of campaign ready strategies right out of the box.

Ideas to Development

Ideas can come from anywhere. I talked about this in previous emails, it’s not that hard once you get in the swing of generating ideas, as a matter of fact, this is the fun part of this process, the part where you’ll spend most of your time, perhaps 75% in total. This is where the magic happens. There’s a definite process and you build upon things that are known to work, and hopefully discover more things that work from time to time.

If an idea is a flop, then you scrap it. If it makes it through you initial evaluation, and shows some promise, it can go into the curation process. Your main job is to think of this process like a factory, where you need to develop lots of small ideas of reasonably high quality.

Strategy Curation

This is where your strategy goes through both in sample and out of sample testing. That simply means historic and live market data. The testing process is the key here, and the goal is to weed out the good from the not so good, so that after time a strategy shows its true colors and proves that it’s ready.

This is the boring part of the process, but perhaps the most important. You spend about 15% of your time here. Once a strategy has proven it works under lots of conditions and is robust and shows a low degree of correlation to other strategies in the live campaign, it sits and waits for the opportunity to join the game.

Live Campaign

Campaigns are like serial projects. This is where all the live trading takes place. A new campaign starts periodically, let’s say every three months. Thats enough time to evaluate how well the strategies are doing, and decide whether they deserve to stay in the game, or get replaced by a curated strategy waiting on the bench.

Not all strategies live forever. Sooner or later they loose their mojo, and with have to be retired permanently or put back into the curation process. Every once in a while, they can be recycled;ed into new strategies, which is not depicted on the graphic.

Conclusion

So that’s the entire process from end-to-end. There’s obviously a lot of detail left out for the sake of brevity, but in essence that is it. The key take aways here is that you don’t have to sweat over perfect strategies. Ok is good enough, so long as it’s non correlated with other strategies.

You scale your system simply by getting more strategies into the live campaign, and spreading the risk between them.